Fighting Fraud in the Small Business Workplace

Workplace fraud is an ongoing issue in Canada and small businesses are particularly vulnerable since there are often limited resources, if any, to devote to fraud prevention. Yet, small businesses are among the biggest targets with revenue losses related to employee-perpetrated fraud estimated at $3.2 billion per year according to Canadian accounting associations.

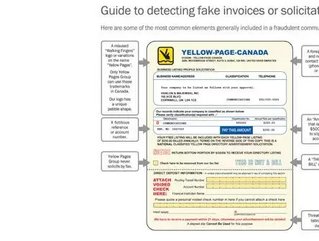

“Fraud in the workplace can cost small businesses big bucks. The easiest way for any business with limited resources to deal with fraud is to put in place simple systems to prevent it in the first place,” said François Ramsay, Senior Vice-President, Corporate Affairs and General Counsel for Yellow Pages Group. “What amounts to very small steps can save a small business owner thousands of dollars and buy them invaluable peace of mind.”

Ramsay proposes the following tips for small businesses looking to develop a fraud prevention program:

• Determine where your company's specific vulnerabilities are in order to create and implement internal prevention controls (e.g. Do you only have one person handling all the finances? Is access to your inventory unrestricted?)

• Know your employees. Check references, employment and educational history for previous history of fraud or illegal activity. If you're filling a position managing assets, consider a credit check with the authorization of the candidate.

• Have security cameras installed to monitor activity at cash registers and in inventory storage areas. Fraud is less likely if people know they're being watched.

• Conduct unannounced audits on specific functions of your business where fraud might occur. Surprise audits act as a fraud deterrent as employees will know it will likely be uncovered.

• Check bank statements yourself and watch for missing cheques, cheques issued out of sequence, unknown payees, cheques which look altered, cheques not signed by authorized signatories, or any other unusual items.

• Use only vendors from a management-approved list which is routinely checked against invoices.

• Develop a fraud policy and communicate it to all employees. This signals not only that you take these activities seriously but also that there are consequences. This in itself can act as a deterrent.

• Take action when fraud is discovered. Having a fraud policy is useless if you are unwilling to enforce it. Consider options such as reprimands, suspensions, demotions, salary cuts, probation, dismissal and legal action for differing levels of fraud.

For more tips on fighting fraud in the workplace as well as information on common scams targeting small businesses, visit: yellowpages360solution.ca/fraud.